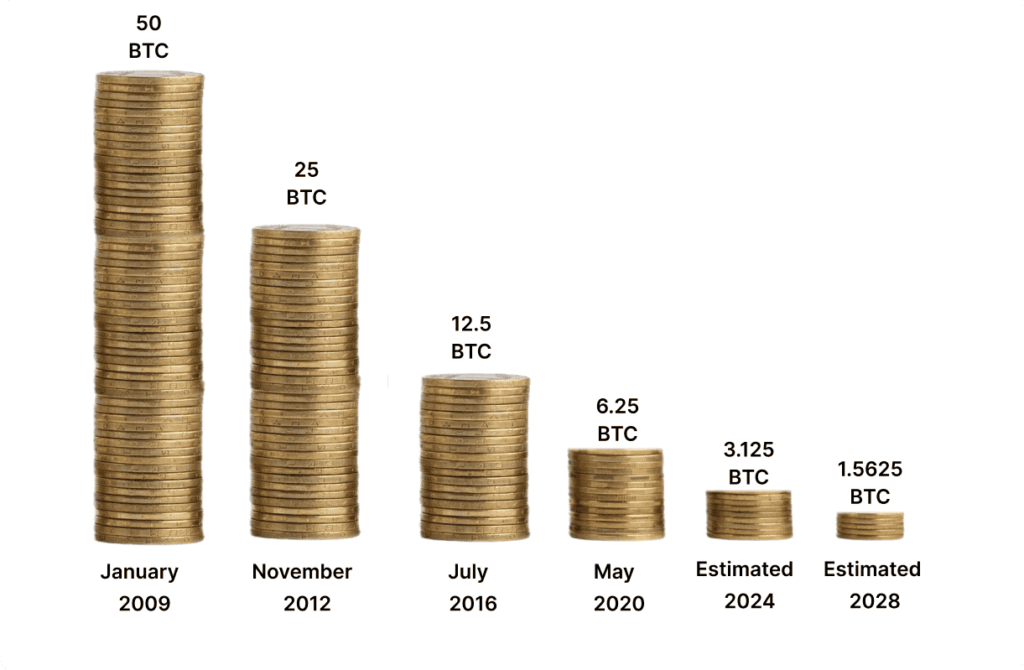

The phenomenon of “Bitcoin Halving” is a cornerstone event in the cryptocurrency world that significantly influences the Bitcoin network and its economy. Scheduled approximately every four years, halving is an integral part of the Bitcoin protocol designed to control the creation of new bitcoins by halving the block rewards that miners receive for securing the network. The Bitcoin halving event on April 20th, 2024 has officially occurred!

Understanding Bitcoin Halving

Bitcoin operates on a decentralized network where transactions are grouped into blocks and added to a public ledger called the blockchain. Miners validate these transactions by solving complex cryptographic challenges, a process that consumes considerable computational power and energy. As a reward for their efforts, miners currently receive 6.25 bitcoins per block, but this number will halve to approximately 3.125 bitcoins post-halving in 2024.

The halving mechanism is embedded into Bitcoin’s code by its anonymous creator Satoshi Nakamoto. This built-in economic model simulates digital scarcity; similar to precious metals, which are limited in quantity, Bitcoin was designed with a cap of 21 million coins, ensuring it remains a deflationary asset.

Bitcoin Halving and Its Impact on Price

Bitcoin’s price is largely governed by the basic economic principle of supply and demand. Halving impacts the supply side by reducing the rate at which new bitcoins are generated and released into circulation. This decrease in supply tends to create upward pressure on the price, assuming demand remains constant or increases.

Historical Price Impact of Bitcoin Halving

To understand how the upcoming 2024 halving could affect Bitcoin prices, we can look at the historical data surrounding previous halvings:

As illustrated in the table, each halving event has been followed by a significant uptick in Bitcoin’s price. While past performance is not indicative of future results, the trend suggests a notable surge post-halving.

Factors Influencing the 2024 Halving Impact

Several factors could modify the effects of the 2024 halving:

- Institutional Adoption: Increased institutional investment in Bitcoin could stabilize demand and potentially drive prices up.

- Regulatory Environment: New regulations or policies could either bolster Bitcoin’s legitimacy and use or create hurdles that stifle its adoption.

- Technological Advances: Enhancements in blockchain technology could improve Bitcoin’s utility and appeal.

- Economic Conditions: Global economic factors, such as inflation rates and currency devaluation, might heighten interest in alternative investments like Bitcoin.

Conclusion

The Bitcoin halving in 2024 is poised to be a pivotal event for the cryptocurrency market. By reducing miner rewards, the halving decreases the rate at which new bitcoins are created, thereby diminishing the new supply and potentially driving up the price if demand remains steady or grows.

Investors should keep an eye on the broader economic landscape, advancements in blockchain technology, and regulatory developments, as these factors could significantly influence Bitcoin’s price dynamics around the halving. As with any investment, due diligence and a balanced view of potential risks and rewards are crucial.